LIFE-STYLE® Final Expense

Product Summary

Three Plan types are available:

Simplified Issue

Graded Death Benefit

Modified Benefit

A small face amount product available to applicants ages 50 - 85 with simplified issue underwriting. The SIWL product is an immediate death benefit plan. An Accidental Death Benefit rider and a Child Insurance rider are available.

Become an Agent

SIMPLIFIED ISSUE

Benefits Per Age Group |

|||

| Issue Age: 50 - 85 | 50 - 70 | 50 - 80 | 81 - 85 |

| Minimum face amount | $3,000 | $3,000 | $3,000 |

| Maximum face amount | $35,000 | $35,000 | $10,000 |

| Premium Payment Period Options | 10 Pay / 20 Pay1 / Life | 10 Pay / Life | 10 Pay / Life |

120 Pay - Only Available for age group 50-70

| Benefit Description | The SIWL, Level Death Benefit plan, pays the face amount while the policy is in force. Subject to policy provisions | ||||||

| Premium Mode Policy Fee |

|

||||||

| Underwriting Classes |

|

||||||

| Guarantees | Level Premiums / Level Death Benefits / Cash Values |

RIDERS (SIWL)

| Accidental Death Benefit | Rider pays a death benefit in addition to the base policy if death is caused by an accident, subject to policy provisions.

|

| Child Insurance Rider | Rider pays a $5,000 death benefit on eligible children

|

GRADED DEATH BENEFIT

Benefits Per Age Group |

|||

| Issue Age: 50 - 85 | 50 - 80 | 81 - 85 | |

| Minimum face amount | $3,000 | $3,000 | |

| Maximum face amount | $25,000 | $10,000 | |

| Premium Payment Period Options | Life | Life | |

| Benefit Description Benefit Grade per year |

Accidental Death Benefit (ADB)

|

||||||||||||

| Premium Mode Policy Fee |

|

||||||||||||

| Underwriting Classes |

|

||||||||||||

| Guarantees |

Level Premiums / Level Death Benefits / Cash Values |

MODIFIED DEATH BENEFIT

Benefits Per Age Group |

|||

| Issue Age: 50 - 85 | 50 - 85 | ||

| Minimum face amount | $3,000 | ||

| Maximum face amount | $10,000 | ||

| Premium Payment Period Options | Life | ||

| Benefit Description Benefit Grade per year |

Accidental Death Benefit (ADB)

|

||||||||||||

| Premium Mode Policy Fee |

|

||||||||||||

| Underwriting Classes |

|

||||||||||||

| Guarantees |

Level Premiums / Level Death Benefits / Cash Values |

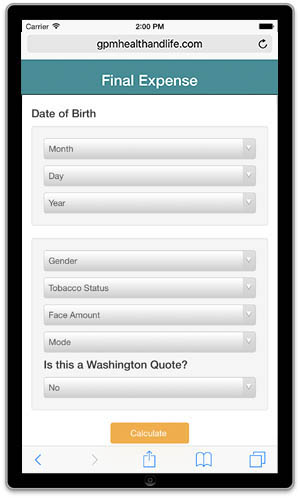

Rate Calculators

If you can't find what you're looking for and would like to ask a question, click the contact us now and fill out a simple form to get in touch with our friendly agent services team.

Contact North Coast Life Insurance Company for complete details